Car Loans: Everything you need to know

The Philippines car market is skyrocketing every year and holds a very positive sentiment for the upcoming years as well. Thousands of new vehicles glide on the Philippine roads every day and every other day we see a newbie launched in this high potential market. A whooping 311,393 units were sold last year and according to the latest Automotive sales report published by CAMPI (Chamber of Automotive Manufacturers of the Philippines Inc.),134,488 units have already been sold in this quarter. The Chamber of Automotive Manufacturers has predicted the sales numbers to hit 350,000 units in 2016. It simply means more cars, more buyers and more car loan applications.

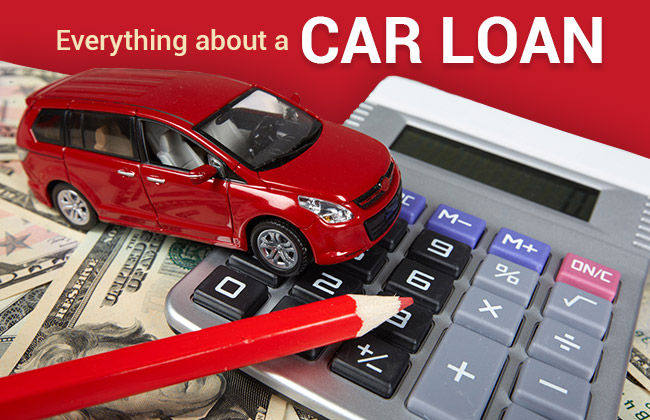

Car Loan is a very vital ingredient in the car buying journey unless you are born with a silver spoon or have a pile of pesos stacked in your vault. But do we all really know how, when and where to get the best auto loans or what is the process and deciding factors for a car loan application? Let’s try to dig deep in the car loan requirements and car loan process a bit.

Are you eligible for a car loan?

Age - You must have celebrated your 21st birthday before applying for a car loan and should not exceed the age of 65 years at the time of loan maturity.

Occupation - Both salaried and self-employed citizens are eligible for a car loan from a majority of the banks in the Philippines.

How much can I get and for what time period?

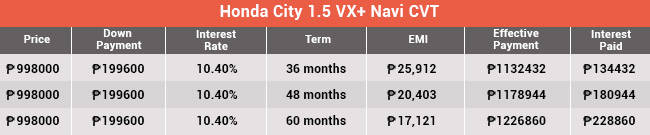

Almost all the banks require a minimum of 20 percent of the car sale price as a down payment and the rest of the amount is loanable. The car down payment is not restricted to 20 percent and you can increase it up to 50 percent, but the maximum amount depends on the bank. The loan term ranges between 12 months till 60 months. The most common myth about a car loan is that a longer term is a better option due to a lower EMI, but a longer term means a high total interest paid and thus the overall effective cost of the vehicle is increased substantially.

The above table clearly shows, the longer is the term, higher is the effective cost and thus higher interest amount paid.

The car loan process :

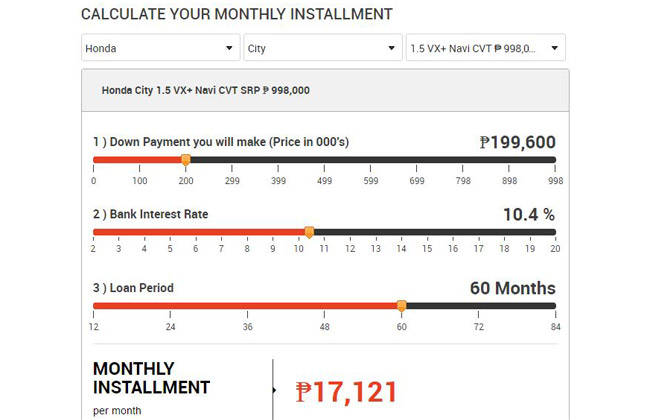

1. Research - It goes without saying that you should perform an in-depth research once you decide to opt for a car loan. Thanks to the digitalization of the world, there is plenty of information available over the internet about car loans. Check out the prices of your desired model and how much loan you would need? Ask yourself whether you will be able to afford the down payments or not? Also, discover the best options available for you in the market. There are umpteen websites providing a car loan calculator on which you can attempt a car loan eligibility test, which will help you to estimate your EMI payments as well. All you need to do is select loan amount required, desirable down payment, preferred loan term, income details etc. If you are not tech savvy, you can surely walk into a bank (or Financial Institution) branch to fetch the car loan details.

2. Documentation - Once you know that you are eligible for a car loan and you have done your research work, you should start arranging all the required documents at one place so that you are ready to apply for the loan. The required documents are slightly different for salaried individuals and self-employed individuals.

Salaried :

- A valid Government issued identification document

- Certificate of Employment from the employer which includes details like your current salary, tenure with the current company, designation in the company and HR contact information.

- Latest Income Tax Return (ITR)

Self-employed :

- A valid Government issued identification document

- Latest ITR

- Financial statements (Properly audited by a professional)

- Business Registration Certificate

- Most recent bank statement

3. Applying - If you follow this procedure, by this stage you are all set to apply for the car loan finally. You can either apply on a bank’s website or by physically visiting a bank branch. Fill the application form with all the required details, submit all the required documents and THATS IT!

The ball is in the bank’s court now. A car loan application is generally processed anywhere in between 6 hours to 24 hours. If there are any discrepancies in the documents or any missing information then the process might get delayed (and the timeframe of delay depends on the cause of delay). But, if all’s good from your end then you can expect an approval within a day.

Check out these quotes from some of the popular Financial Institutions :

The next step in the car buying journey after a car loan surely is to get your car insured. So, if car loan is on your mind, you should also understand the importance of car insurance and how it ensures peace of mind along with financial protection in adverse situations.

Stay tuned to this section for more information on car loans!Sell your car at the best price

Verified and genuine buyers

Verified and genuine buyers

Trending & Fresh Updates

- Latest

- Popular

You might also be interested in

- News

- Featured Stories

Featured Cars

- Latest

- Upcoming

- Popular

Latest Car Videos on Zigwheels

Car Articles From Carmudi

- journal

- advice

- financing

- insurance